A Complete Guide to Canada’s 2023 Income Tax Brackets

- January 22, 2016

- Posted by: manager

- Categories: Professional Services, Taxation

What are Tax Brackets and why do they exist?

In Canada, the marginal tax rate system administered by the Canada Revenue Agency (CRA) is used to calculate the federal income tax owed by individuals. This system consists of a series of tax brackets and rates applied to varying taxable income levels. The tax rate increases as income increases, and each level or bracket is taxed at its corresponding rate. This means that a higher portion of your income is taxed at a higher rate as you move up in income brackets. The CRA updates the tax brackets and the corresponding tax rates each year to ensure Canadians pay their fair share of taxes.

Due to the dramatic global economic changes in 2022, Canada experienced high levels of inflation, prompting an update to the 2023 income tax brackets. This is beneficial for taxpayers as it means that more of their income remains in their pocket and is not subject to taxation. Indexing the tax brackets to the inflation rate is advantageous, as it allows taxpayers to avoid being overtaxed due to rising consumer prices and wages.

The tax system in Canada is designed to protect low-income earners from being unfairly taxed due to inflation. However, when inflation rates are not taken into account for an extended period of time, such as 50 years, wages are likely to increase significantly and as a result, nearly everyone may be in the highest tax bracket. To address this, the government increases the tax brackets in order to ensure low-income earners are not paying more than their fair share. Despite this, current accounting forecasts predict a decrease in inflation rates in Canada by 2024, which could result in less of an adjustment to the federal income tax brackets. By keeping up with inflation rates and adjusting the tax brackets accordingly, the Canadian government is able to ensure that low-income earners are not unfairly taxed.

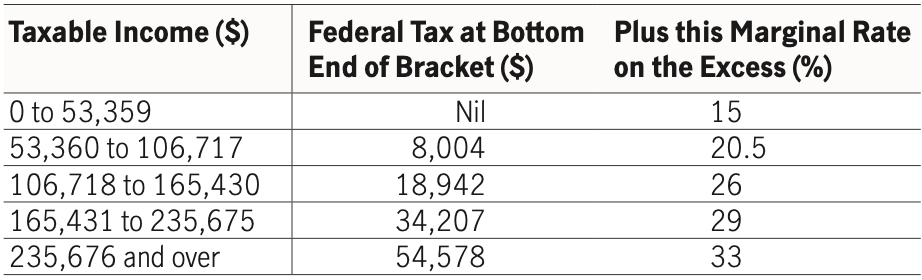

2023 Federal Tax Bracket

Canada Revenue Agency (CRA) increased the federal tax brackets by 6.3% to account for inflation. This means that Canadians will be taxed at a higher rate for income earned that year.

Canadian taxpayers who earn between $15,000 and $53,359 of taxable income per year are subject to a base 15% tax rate. This rate applies to all income earned within that income bracket.

How will the new tax brackets affect Canadians?

Tax brackets are an important component of managing your finances wisely, especially for those earning $50,197 or more. Inflation-indexing tax brackets help to maintain a consistent tax rate, despite varying economic conditions. In 2023, the first threshold for the 20.5% tax rate is $53,359, a significant increase from 2022’s $50,197. Knowing the updated tax brackets can help you plan your finances for the year, maximizing your RRSP contributions and tax deductions. Inflation should also be kept in mind when considering salary negotiations, since a 6.3% raise in 2022 may not be enough to keep up with the changing economic conditions. Therefore, it’s important to mention inflation during performance reviews with your boss so that you can hopefully receive a wage increase that will match the increase in the cost of living.

Every year, tax rates and brackets change, no matter how small the changes may seem. However, these small adjustments can have a considerable effect on your financial situation. To ensure that you are making the most of your finances, it is vital to comprehend how the evolving tax rates and brackets will influence you and your family. One of the most effective ways to do this is to collaborate with Insight Accounting CPA to develop and execute tax planning techniques. This will not only help you save money but will also provide you with the necessary tools to manage the impact of changing tax rates. By getting in touch with our CPA-certified tax consultants, you can take control of your finances and make sure that you are getting the best results.

Our team of experienced professionals is dedicated to helping business owners optimize their financial plans to minimize their taxes and maximize their wealth. Our comprehensive services include a full range of wealth management and financial planning services to address your current and future needs. These services include cash flow analysis, strategic tax planning, retirement planning, estate planning, and insurance planning. We also offer comprehensive tax services, including personal and corporate tax preparation, tax planning, and audit representation. Our goal is to help you maximize your tax savings and build long-term wealth for the future. With our team of experienced professionals, you can trust that we have the knowledge and expertise to provide the best advice for your unique situation.

Consultation

To learn more about which Tax Bracket you fit in and how you can maximize the tax savings, please speak with one of our advisors HERE